Go to Market Strategy: A Comprehensive Guide for Marketing Executives

Introduction to Go-to-Market Strategy

The “Go to Market Strategy” is one of the projects for which preparation is generally more difficult (and more important) than execution. What makes GTM so challenging is how it depends on the products or solutions about to go to market. By documenting my experience as a fractional CMO, I aim to help marketing executives gain a new perspective in their GTM strategy. Here is the good news: I will not be approaching GTM with a legacy approach.

What is a Go-to-Market Strategy

In simplest terms, with GTM, you plan how to introduce your solution or product to the market. You are literally planning on going to market to be tested, questioned, and judged by your potential target personas.

Steps to Develop a Go-to-Market Strategy

Step 1: Market Research

Market research is based on identifying two main pillars: what competition proposes and what customers think they need. I used the word “think” on purpose because, at this stage, what customers think they need takes priority over what they actually need when it comes to architecting your core messaging. Remember, the habit-forming products or services that users widely use create the assumption of what they may need, although your solution can actually help your target market redefine their “needs.”

Step 2: Define Target Audience

Who are your buyers? What should happen in an organization while deciding to be your customer? What personas are involved in the decision-making process? Are there any demographics you want to target?

It may be relatively hard to identify target personas if you are new in the business as you don’t have enough sample size to make basic assumptions, but there are things you can do to collect this data.

Many think that keyword research and prompt research are for SEO purposes only. This isn’t true, as gathering data about what people search for to land on your competitors’ business is a solid way to identify your target audience (especially when your competitors pay for certain keywords to attract such traffic).

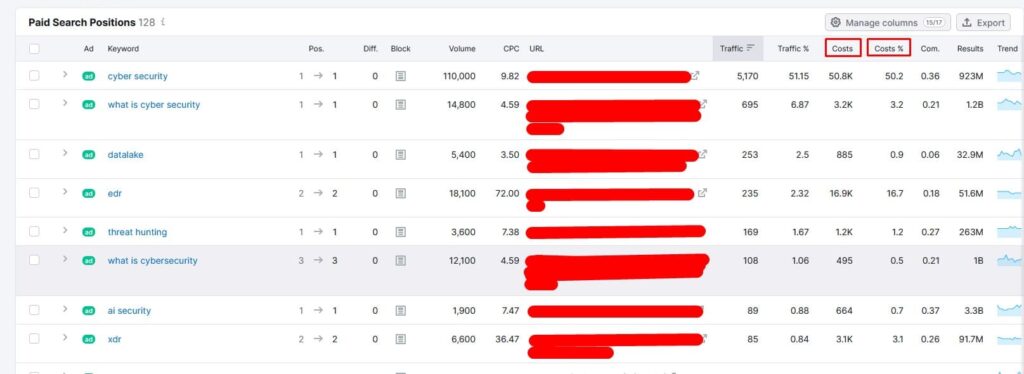

SEMRush

- Type your competitor’s name into the search box and submit.

- Scroll down to “Top Paid Keywords.”

- Click “View details.”

- On the result page, you can also sort the metrics based on cost or cost% to identify your competitor’s priorities.

- Go to advanced filters and select exclude | keyword | containing | [input your competitor name]. This filters out brand searches so you can view solution-related searches to analyze target audience needs.

Here is the result:

AI

Although it requires thorough manual checking, AI can be your best friend when identifying target personas initially. Start with this prompt:

I have a B2B cybersecurity solution. Help me identify my target personas and the key decision-making titles involved in assessing this solution.

You will get a response something similar to this: CISO, Compliance Officer, IT director, etc.

As a marketing executive, use your knowledge in the field to extract more specific information from AI. For instance, companies with stringent regulatory requirements are more likely to be potential buyers for a cybersecurity solution. Here is an example prompt:

What industries have stringent regulatory requirements?

You will get a response such as: Finance and banking, Healthcare, Energy and Utilities, etc.

Now that you have some idea for the titles and industries for your audience, use LinkedIn to extract them.

Chief Information Security Officer” AND “Finance” AND “New York”

With this search, you can filter your target base based on the title, industry, and location.

Now you know:

- Keywords your target persona use to research the solution for a problem they think they need

- Industries and titles that are more likely to be your customer

- Names and titles of these potential buyers.

Ready to create the buyer personas?

Let’s employ AI to create the buyer personas:

- Search for (“Chief Information Security Officer” AND “Finance” AND “New York”) on LinkedIn.

- Select 5 profiles from the results.

- Type the following prompt on AI:

“Create buyer personas for these titles for a potential cybersecurity customer.”

After reviewing the result, input the following: “Now combine the 5 profiles into one persona.” Repeat these steps for each title, industry, and location.

Here is the result:

Not bad for a start, huh?

Step 3: Value Proposition

Use the information you gathered during your market research and reconsider how you present your value proposition. Remember, when you are in the GTM stage, perceived value matters the most. Create multi-level value propositions to use in different mediums. I covered this topic in depth in my Value Proposition article.

For a brand to have a conscious decision-making process during GTM planning, it’s necessary to meet your target market’s thought process where they currently stand before introducing them to a better solution to avoid initial friction. This is what makes market research the first and most critical step in building a GTM strategy because it is also the foundation of solution-level value proposition development. Here is an example (in cybersecurity):

- What customers think they need: Cybersecurity software that provides malware detection for their organization.

- What your competition proposes: Malware detection

- What does your software do: Protects you against malware before it can enter the system without having to detect it (virtualization).

- Your original solution-level value proposition: Detection-based posture doesn’t work because unknowns cannot be detected, hence we solve this problem with a zero-trust method.

- Meeting point: Malware detected: ZERO [insert how]

The meeting point is where you communicate your value without disconnecting from what your target audience has in mind, while not contradicting your original value proposition.

Although your solution is innovative and probably better than your competition in terms of solving a problem, your original value proposition creates friction in your target market. Your audience thinks from a detection perspective, and any claim that suggests “what users think they need is incorrect” will create distraction and friction (effort they need to put into validating your claim). When you word your value proposition using terms that align with “what users think,” you meet your target market’s current buying mindset.

Your market research will include data from trends, identifying what your users actually think they need rather than something even better you have to offer.

Step 4: Marketing and Sales Strategy

Webinars, events, marketing collateral development, content marketing, social media, email marketing, SEO, and paid advertising are all commonly known channels for CMOs. Listing these channels falls under a more basic area of topic, so I will skip identifying each one of them.

The key component here is to understand that the marketing strategy is defined based on the previous steps you have completed. Your marketing strategy is defined, in simplest terms, by how you communicate the results of your market research, value proposition, and target audience research. Organizing task lists or scheduling updates with an efficient marketing coordinator would not be an issue as long as you have completed the steps up until this point.

Organizational Alignment Directly Impacts Your Messaging:

I am not a big fan of the “floors” in the sense of “sales vs marketing floor.” I think perceiving these two main functions as two departments and setting them distinctive goals is an outdated CEO approach. “Sales” is not the name of a department, but rather, it is what all departments want to accomplish; it’s a goal rather than a job. If you communicate your take holistically with everyone in your organization and explain how everyone (regardless of their role) is part of the sales process, you will see that the output of the efforts from each employee and department will be more purposeful for the end goal: sales.

The best example of how the sales vs. marketing approach is outdated is account-based marketing. Most companies still use marketing for “early touches” and bring sales in “down the funnel.” Structuring the ABM process between departments not only confuses the target persona but also causes a lack of consistency in tone. With a holistic approach, you will not have to worry about dividing KPIs between marketing and sales because you will assign accounts to a group of people to deliver end sales. When a business talks to other businesses, it should sound aligned in communicating the value proposition. Establishing this unified tone can be difficult when multiple departments converse with the same decision-maker.

Planning on Your Marketing Channels:

Yes, being everywhere simultaneously would be great, but budgeting, timelines, and goals may require you to prioritize the channels for distributing your content and outreach. The most practical way I experienced prioritizing was to refer to the results of your marketing research to determine buyer personas. When you identify your target audience, you will likely have a solid idea of which channels are the best to reach them.

Pricing Strategy:

One of the most controversial areas in go-to-market is the pricing strategy. There are several approaches when it comes to pricing your solutions accurately, such as cost-plus, competitive, penetration, skimming, dynamic, and value-based pricing. Following these pre-defined pricing strategies without extensively analyzing the unique circumstances of the offering is something that I disagree with. You can actually follow multiple of these strategies by developing hypotheses to see what works best for your solution. The issue is not one approach being better than the other but rather applying them without conducting thorough market research. Current buying behavior, purchasing power, and overall cost-benefit analysis are key points to get started building an effective pricing strategy.

While “cheap” or “expensive” can be subjective based on your prospects’ buying power, “cheaper” or “more expensive” is not.

There is an inverse ratio between cost-benefit and the strength of your value proposition (and overall marketing power). The better value you can have your target audience perceive, the more flexible you can be when it comes to pricing your solution competitively.

Ask the following questions to determine your pricing strategy:

- Does my solution/product solve major problems my competition can’t? If yes, do you have the capability (budget and efficient marketing team) to communicate this?

- What drives my competitor’s customers buying decisions (cost vs value)?

- Do I have better brand credibility than my competition (brand-level value proposition)?

- Are all or some of your competitors use prestige pricing that works?

0 Comments